Shipping Protection: Is It Worth It? Benefits, Costs, and Tips

Every damaged package silently saps $23.32 from your store’s profits, a study by Pregis reveals. What’s more concerning is that 73% of these customers never return to your business.

You could be facing your next shipping disaster tomorrow. Is your bottom line ready to face such a challenge? When it comes to business, it doesn’t matter who’s at fault. Customers always expect the business owner to set things right.

This guide illustrates how shipment protection allows you to keep your customers happy without paying for any damages out of pocket. Read on to find out more.

What is Shipping Protection?

Shipping insurance safeguards packages from damage, loss, and theft during delivery. It covers mishaps that happen anywhere between the warehouse and the customer’s doorstep. When deliveries go wrong, this service steps in to protect both merchants and buyers from financial losses.

Standard carrier coverage often promises protection but delivers frustration instead. Their claims processes require extensive documentation and can drag on for weeks.

Many claims get denied due to technicalities or because the incident occurred after the official delivery scan. This leaves merchants caught between unhappy customers and unrecoverable costs.

Protection solves these problems through:

- Quick and simple claims processing without excessive paperwork.

- Coverage for situations carriers typically exclude, including porch theft.

- Nearly full reimbursement, including both product value and shipping fees, depends on what kind of protection service you select.

- Clear responsibility without the typical passing of blame between parties.

Merchants can offer this as an optional checkout add-on or add it to the cart. Either approach transforms potential delivery disruptions into service recovery opportunities. When shipping mishaps occur—brands can still create loyal customers through prompt resolution.

Benefits of Shipping Protection for Merchants

A 2023 CivicScience study found 56% of surveyed consumers had problems with package deliveries, including loss, damage, and theft. When you offer shipping insurance, you help your business avoid the financial impact of such challenges.

All while keeping patrons happy and building a strong reputation! Let’s take a closer look at how shipment protection adds to the strength of your business.

1. Protect Profit Margins While Enhancing Customer Experience

Shipping protection safeguards your business from absorbing the costs of lost or damaged packages.

Every protected order means you can recover these losses through covered claims instead of writing them off as expenses. At the same time, customers receive quick resolutions without the frustration of proving their case.

This dual benefit keeps revenue steady, minimizes financial disruptions, and turns potential negative experiences into positive ones. Your team can focus on growing sales and improving customer service instead of handling shipping problems.

2. Drive Higher Order Values Through Customer Confidence

Customers shop more confidently when their purchases have protection. This confidence leads to bigger orders and higher average order values.

The numbers by Cover Genius speak clearly: 60.1% of consumers would purchase insurance from their e-commerce retailer at checkout if offered. Better yet, 78% said they’d likely spend more online when given options to protect purchases, especially for expensive items.

With shipping protection, you can create a worry-free shopping experience that builds trust. It encourages repeat business and drives positive word-of-mouth as well.

3. Minimize Financial Losses From Payment Disputes

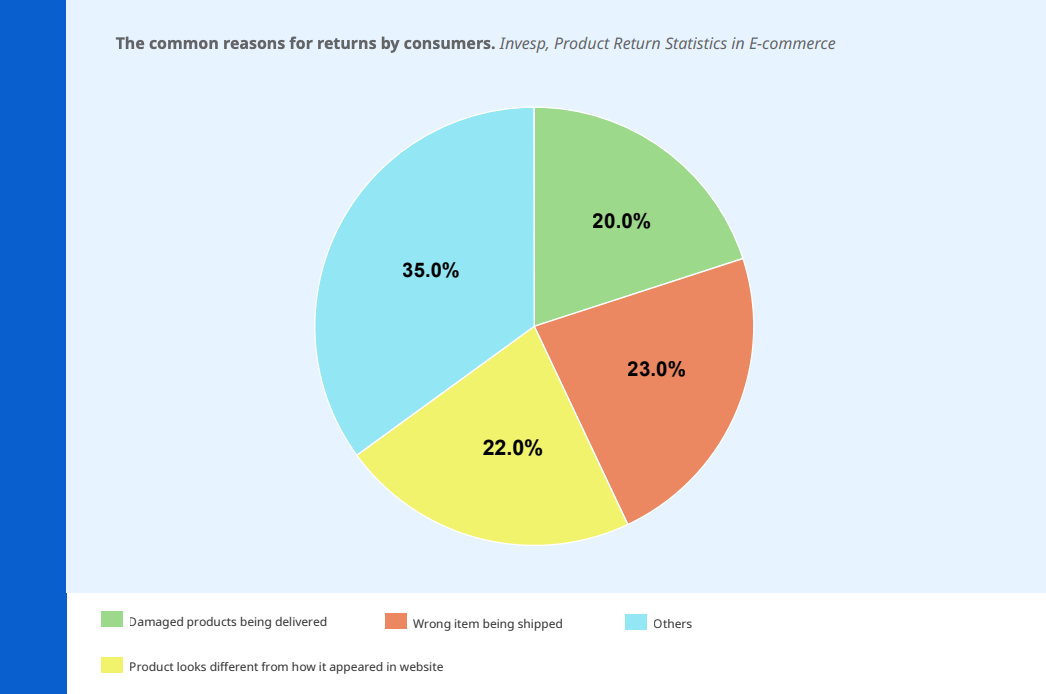

A recent analysis by Invesp found that approximately 20% of returns are due to products arriving damaged. Shipping protection minimizes these disputes through an easy resolution process. Fewer chargebacks mean less administrative stress and fewer financial setbacks for your business.

Image from: The History, Evolution, and Future of Reverse Logistics

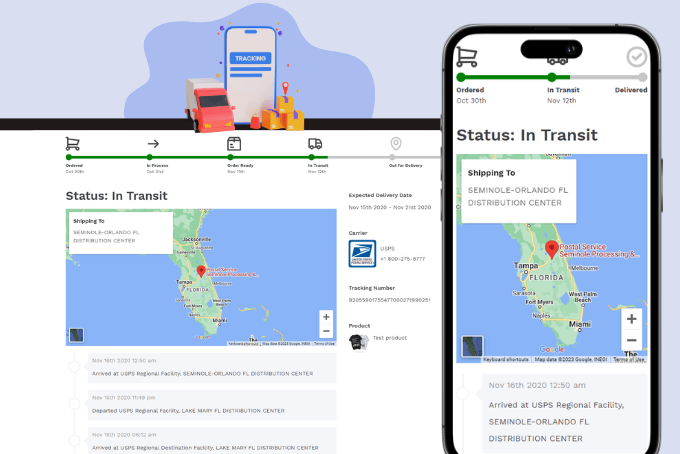

4. Optimize Shipping Strategy With Data-Driven Insights

Some shipping protection software and programs collect detailed data on shipment losses, damages, and delays. This data reveals patterns that help businesses find high-risk areas and adjust strategies accordingly. Integration of predictive analytics enables companies to optimize packaging, choose more reliable carriers, and reduce shipping costs.

With them, you’ll be able to pick more reliable carriers and improve overall delivery reliability. Over time, this will cut down on shipping problems.

5. Stand Out in the Market and Attract More Customers

A secure shopping experience helps your business stand out in the market. Research in the Journal of Electronic Commerce in Organizations indicates that ensuring optimal order condition and prompt discrepancy handling significantly enhances customer loyalty.

So, shipping protection is increasingly becoming a key differentiator for online retailers. Customers actively seek out and prefer merchants who offer this added security.

Moreover, this competitive advantage leads to higher conversion rates, increased customer acquisition, and stronger customer retention.

How Much Does Shipping Protection Cost?

Shipment protection costs vary based on who covers the expense, the claims process, and what’s covered. Below is an overview of the four main types, including typical cost ranges and coverage details.

1. Merchant-Paid Shipping Protection

Here, you incorporate the protection cost into product prices or shipping fees, absorbing the expense yourself. In this model, you handle claims internally for lost, damaged, or stolen packages.

Typically, merchants factor in an extra 1–3% of the order value to cover potential losses. This method gives you complete control over claims resolution and covers all types of incidents, but it increases your financial risk and workload.

2. Carrier Insurance (Shipping Carrier Liability)

Major carriers include shipping insurance as part of their service, so the cost is indirectly covered by you or your customer via shipping fees. The carrier processes claims using its procedures. Coverage usually focuses on lost packages and may not extend to damages or theft.

Quick Cost Overview by Major Carriers:

- USPS: Starting at $2.75 for low-value shipments

- FedEx: Free up to $100; then roughly $4.20+ for higher values

- UPS: Free up to $100; then about $3.45 for moderate values

This option offers a low-touch process, but its limited scope can leave gaps in protection.

Please note that the above fees are subject to variations based on package weight, size, and service type.

3. Third-Party Shipping Insurance

Do you want to reduce administrative tasks and financial risk while maintaining excellent customer service? If yes, then consider options that outsource the claims process.

An external insurer provides coverage when you or your customer pays an extra fee. It is often around 1% of the declared value. This option typically covers loss, damage, and theft and handles claims externally for faster resolutions.

For example, a $500 shipment may cost about $5 in premiums. This model reduces your administrative burden while offering broad protection, though it might slightly increase overall costs.

4. Customer-Paid Shipping Insurance

In this model, customers have the option to opt for shipping protection before proceeding to pay. Customer-paid insurance is practically free shipping protection for the merchant.

These protection services vary by provider in terms of pricing, coverage, and claim handling. Some charge flat fees at checkout, while others use percentage-based pricing. Coverage may include loss, damage, and theft, with claims managed by either the provider or a third-party insurer.

For example, ParcelPanel offers coverage for loss, damage, and “porch piracy”, with costs based on order value. Fees include a flat rate of $0.98 for orders under $100 or a percentage-based fee ranging from 1.5% to 5% for higher-value orders. Claims are managed by a dedicated insurer, reducing financial risk and operational overhead for merchants.

Both third-party and customer-paid models provide reliable, comprehensive coverage and external claims management. These choices let you keep operations lean and focus on growing your business.

Quick Overview: Shipping Protection Types and Potential Costs

| Shipping Protection Type | Who Pays? | Typical Cost | What’s Covered? | Claims Process | Pros | Cons |

| Merchant-Paid | Merchant | 1–3% of order value | Loss, damage, theft | Handled by merchant | Full control over claims | Increased financial risk |

| Carrier Insurance | Merchant or Customer | Varies by carrier; may range from $2.75 to $4+ | Primarily loss (limited theft/damage) | Carrier processes | Built-in with shipping cost | Limited coverage |

| Third-Party Insurance | Merchant or Customer | ~1% of shipment value; may vary | Loss, damage, theft, delays | External insurer handles | Broad coverage, fast claims | Additional cost |

| Customer-Paid Insurance | Customer | Varies by shipping protection provider; may range from 1.5% to 5% of order value | Loss, damage, theft, delays | Managed by provider | No cost to merchant, full coverage | The optional nature makes coverage inconsistent |

Green Shipping Protection: A Smarter Way to Shop Sustainably

You’ve learned about shipping protection, its different types, and what might work best for your eCommerce business. But here’s another important factor to consider when making your choice—green shipment protection.

So, what is green shipping protection? It is a way to keep your packages safe while also helping the planet. Green shipping insurance works just like regular shipping insurance, but with an added benefit: offsetting carbon emissions.

A PwC survey revealed that more and more shoppers want to support brands that care about the environment. Offering green shipping protection builds customer trust but also shows a real commitment to reducing shipping’s impact. It is a key strategy to build your online store’s brand reputation as well.

Choosing the Right Shipping Protection for Your Business

With so many options available, it’s important to choose a plan that fits your business needs without adding unnecessary costs or complications. Below are important factors to consider when deciding on the best shipping protection for your store.

When to Consider Shipping Protection

Not every shipment needs extra coverage, but certain factors increase the risk of loss or damage:

- Product Value: Protection is a smart choice to cover items that are high-value and expensive to replace.

- Order Volume: A high volume of shipments means more chances for things to go wrong.

- Shipment Distance: The farther a package travels, the higher the risk of mishaps.

- Product Fragility: Delicate or breakable items need extra security.

How to Choose the Right Shipping Protection

Step 1: Identify Your Needs

- Look at past shipping issues to understand your biggest risks.

- Decide what level of protection makes sense for your products and shipping patterns.

Step 2: Check Carrier Compatibility

- Ensure the protection plan works with your preferred shipping carriers.

- Confirm coverage for all regions where you ship, considering both domestic shipments and international shipments.

Step 3: Evaluate the Claims Process

- A simple, hassle-free claims process keeps customers happy and saves you time.

- Avoid solutions that require excessive paperwork or have long resolution times.

Step 4: Assess Customer Support

- Choose a provider with responsive and helpful support.

- Make sure they offer assistance specifically for claims and customer inquiries. A dedicated customer support team is an advantage.

Step 5: Consider Value-Added Features

- Look for benefits like order tracking and proactive refunds.

- Some providers offer eco-friendly options, like carbon offset programs.

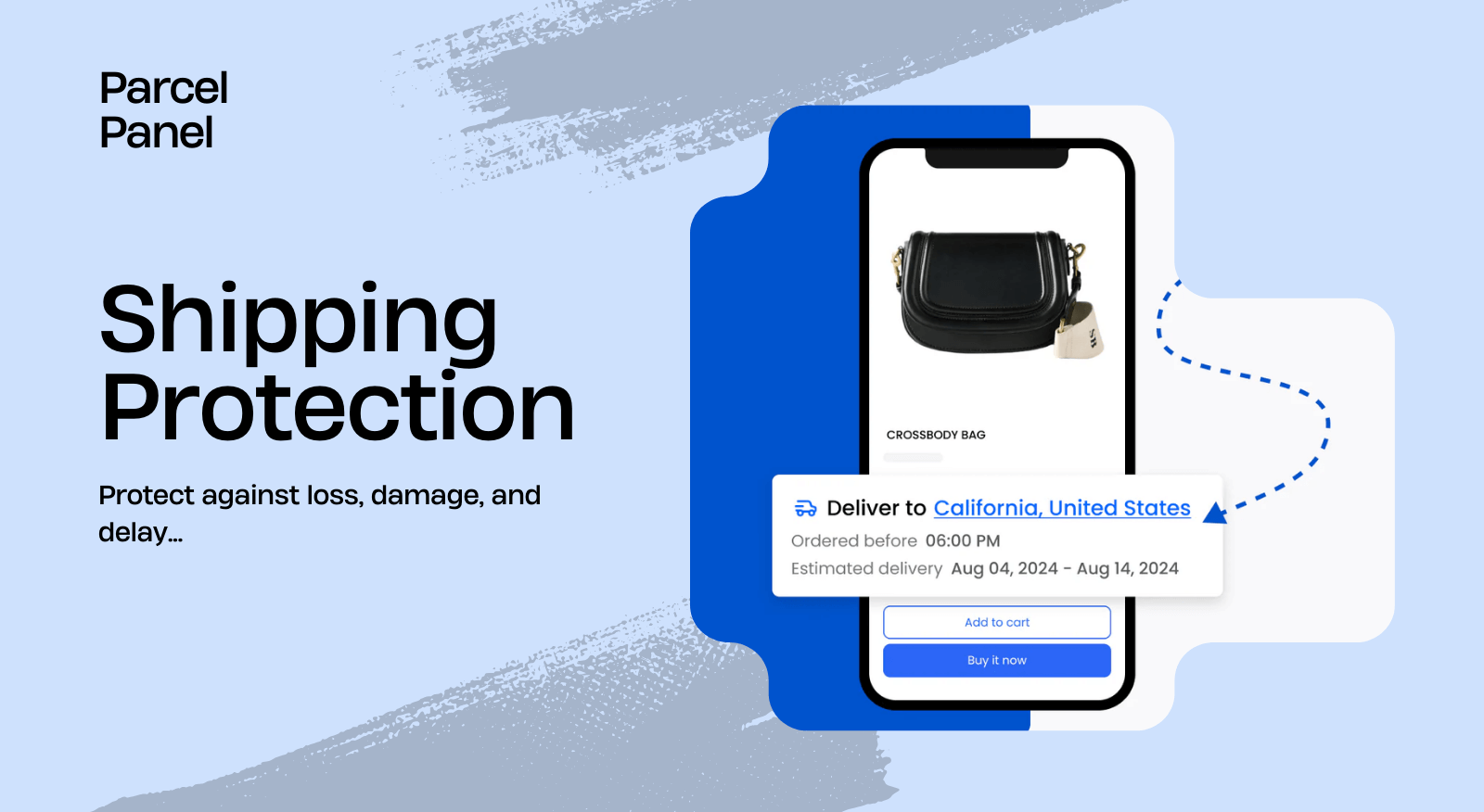

ParcelPanel Shipping Protection: Worry-Free Delivery Made Simple

You’ve learned all about shipment protection…now, let’s make things easier. Finding the right balance between customer satisfaction and operational efficiency can be tricky, but ParcelPanel Shipping Protection offers a solution that works for everyone.

ParcelPanel provides order tracking and shipping protection solution. It helps eCommerce businesses streamline post-purchase experiences while reducing financial risk.

With Worry-Free Delivery at checkout, customers can easily protect their orders from loss, damage, theft, and delays. The best part? You don’t have to manage claims. ParcelPanel handles everything, saving you time and reducing support hassles. The cherry on top is that it is a green shipping protection provider, serving eco-conscious customers well.

Why ParcelPanel?

- Increase sales: It helps customers feel more confident checking out with easy integration on the check-out page or the cart.

- Lower support workload: Spend no more time resolving shipping issues. Claims are handled directly by our cooperater – Seel, a licensed US insurance provider.

- Protect your margins: Since customers opt in and pay for coverage, your business avoids unnecessary costs.

- Fast claims processing: Its claims are reviewed and resolved within 48 hours, with a 95% claim success rate.

- Seamless integration: Works with 1,393 carriers and 50+ apps for effortless setup.

Getting started is simple. Activate ParcelPanel Shipping Protection today or book a demo to see how it works.

Final Words

Shipping protection protects your business and customers from unexpected delivery issues. It reduces financial risk, enhances customer trust, and improves operational efficiency.

With solutions like ParcelPanel, you can offer worry-free delivery, streamline claims, and boost revenue. Activate shipping protection today to create a better post-purchase experience for your customers.

Shipping Protection FAQs

Is Shipping Protection Worth It?

Yes, shipping protection is worth it for businesses and customers. It reduces financial losses, streamlines claims, and enhances customer trust by covering lost, stolen, or damaged packages.

What is Shipping Protection Warranty?

A shipment protection warranty ensures reimbursement or replacement for lost, damaged, or stolen packages. It provides financial security for merchants and peace of mind for customers.

Is Shipping Protection a Scam?

No. Shipping protection is a tried-and-tested method to provide real coverage for shipping issues. However, it is always advisable to choose insurance providers with a well-recognized reputation. Their reliability in terms of claims processing and customer support is also important to note.

What is Shipping Protection on Shopify?

Merchants can offer an optional service that reduces the burden of shipping issues at checkout. This is the essence of shipping protection. It takes care of delivery problems while decreasing support workload. It also contributes to a better customer experience.